An Employer Identification Number (EIN) is issued by the Internal Revenue Service (IRS). It’s unique to the company, cannot be used for a second or other company, and may be obtained online if you have a Social Security Number (SSN), or by fax if you do not.

Please follow the instructions below to obtain an EIN online. This assumes an owner or manager has an SSN. If there is no one with an SSN willing to be the responsible party, then you must apply via fax. Use this link for faxing a non-resident EIN application to the IRS. In short, you must fax a completed SS-4 if no owners or managers have, or are willing, to use their SSN.

All companies must have an EIN. The Employer Identification Number is required to file taxes, have employees, open a bank account, the CTA BOI filing, and more. In short, you cannot avoid applying for an EIN. Every company we form, or act as registered agent for, receives a free EIN and CTA/BOI filing, so our clients need not stress about this matter. We do everything for you.

Note, the following information applies to Limited Liability Companies (LLCs), but very similar information is required to apply for Corporations, Limited Partnerships, Trusts, etc.

Do I Need to File a BOI Report?

Answer these 4 simple questions to find out if you need to file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN).

How to Get an EIN Online?

You may follow the instructions below, or use our service.

How Long Does it Take?

If someone associated with the company has an SSN, then you can apply online and the number generates instantly. There are sometimes error codes. This is out of your control and determined by the IRS. If there’s an error, or you need an EIN for a non-resident, then you must fax the application which can take 4-6 weeks. Sometimes, the application needs to be resubmitted, and will thus take longer.

Does Your Business Need an EIN?

Yes. The new Corporate Transparency Act by FinCen requires all companies to have an EIN. Additionally, the EIN is needed to open a bank account, file taxes, and have employees. Given the above, there is no avoiding the EIN application process.

Do I Need to File a BOI Report?

Answer these 4 simple questions to find out if you need to file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN).

To complete the application online, this information is required:

- Company Name, County & State

- Entity Type

- Number of Owners

- Why You’re Applying (New Company, Hired Employees, CTA, etc.)

- Responsible Party

- State of Formation

- LLC Location

- Industry Specific Questions (Real Estate, Transportation, Gambling, etc.)

You may complete the below form, or use our service as every company we represent, whether a new formation or agent switch, receives an EIN free of charge. Simply complete our questionnaire and we handle the rest for you.

The IRS application begins here: https://sa.www4.irs.gov/modiein/individual/index.jsp

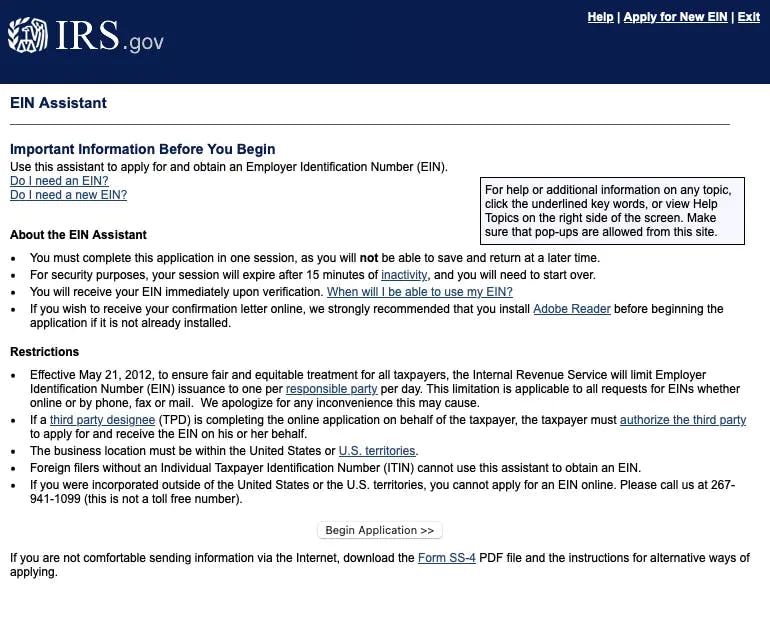

- “You will be required to sign a disclaimer stating the system is for authorized use only, you consent to monitoring, interception, recording, reading, copying and capturing by authorized personnel….There is no right to privacy in this system”

- In short, all information submitted to the IRS is monitored and has no right to privacy. This statement shouldn’t scare you as most government sites have similar warnings.

Once you accept the warning, the next page you see provides additional disclaimers and responsibilities. Click “Begin Application” to proceed.

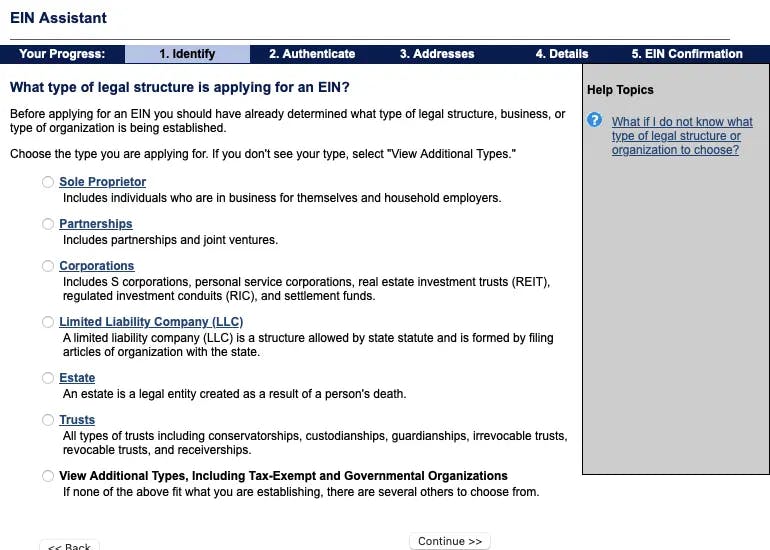

After accepting the above, the IRS begins asking for company specific information. The first question, which determines the rest of the flow, is the type of entity you are applying for. Here we assume it’s an LLC, but regardless, the requested information is highly similar. The other options include Corporations, Limited Partnerships, Sole Proprietorships, Estate, Trusts, and others.

Each has its own user flow, but the intent remains the same. The IRS wants to determine the person(s) with control over the company, whether any taxes are due, and whether special considerations should be made, e.g. Non-Profit Corporations.

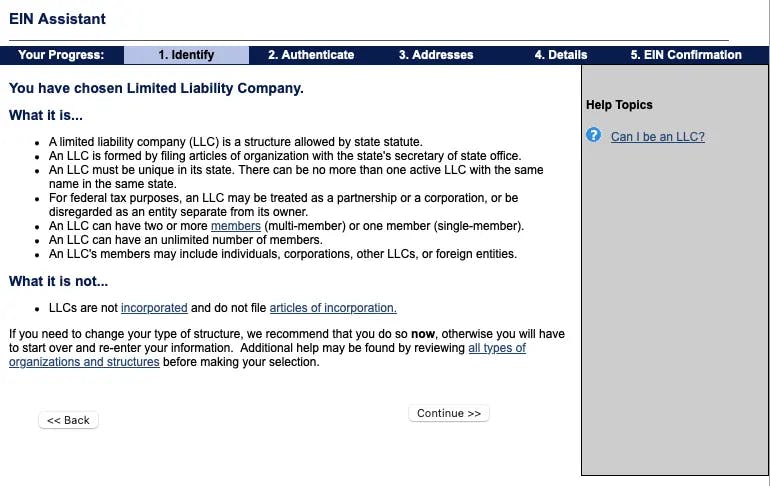

The page following provides explanatory details for the entity you have chosen. In this case, it explains an LLC is an entity type allowed by state statute, is formed using Article of Organization, cannot have the same name as another LLC in that state, how it’s taxed, and other such details.

Selecting a Corporation, or trust, provides similar information, e.g. allowed by state law, formed using Articles of Incorporation or Trust Agreement, cannot be identically named, tax requirements, etc.

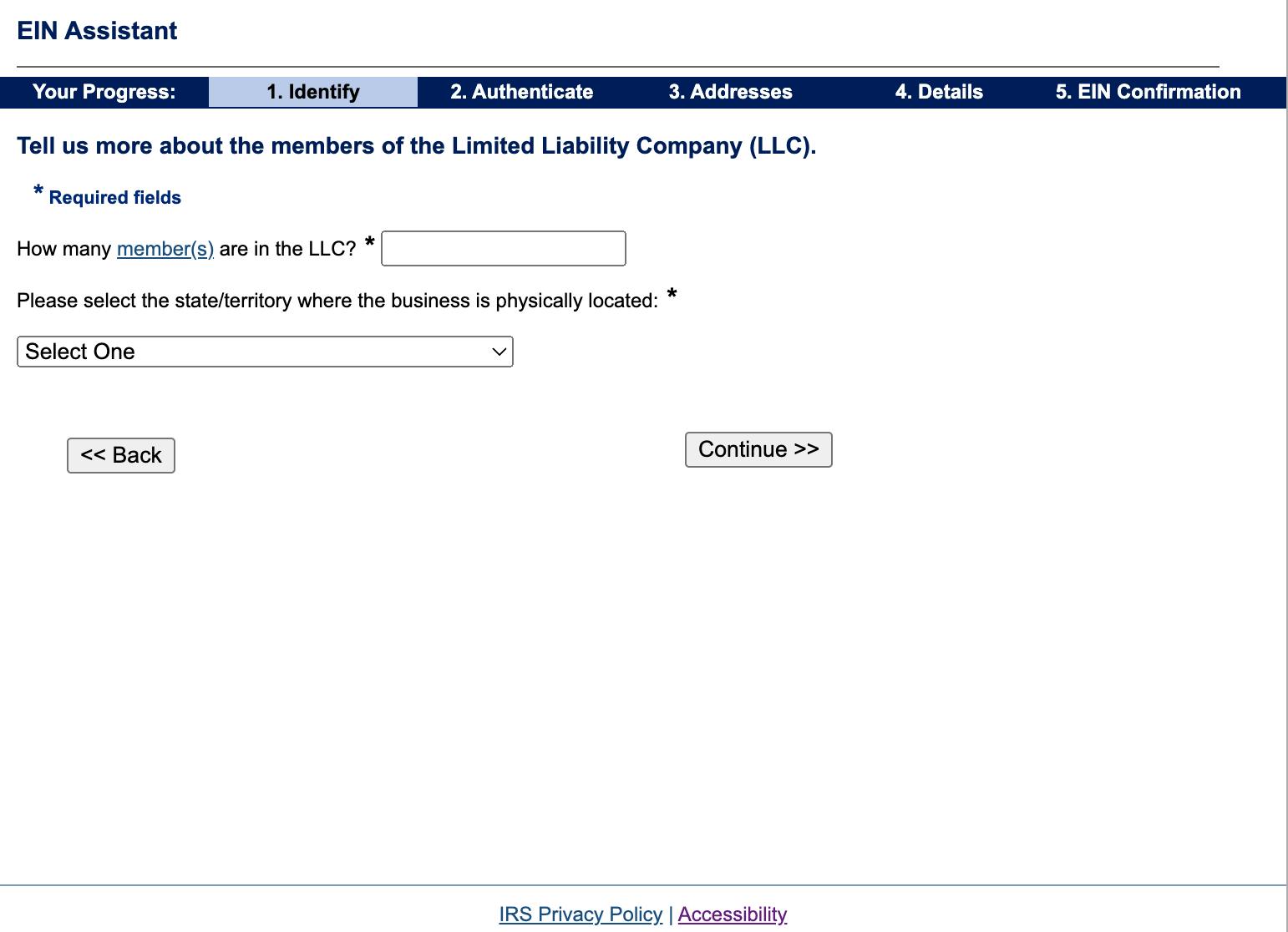

You must now choose the number of members/owners and where the LLC is physically located. This refers to where the LLC will be conducting business or operations, not where the Articles were filed. There can be confusion here given location independent companies, foreign entity registrations, and other extenuating circumstances whereby the company’s address is different from the registered agent’s, etc.

Unfortunately, the IRS does not provide additional clarifying information when choosing. It simply states the field is required and nothing more on the website. The SS-4 instructions advise, regarding county and state, to provide the primary physical location. We recommend using your most faithful interpretation of where the company is physically located.

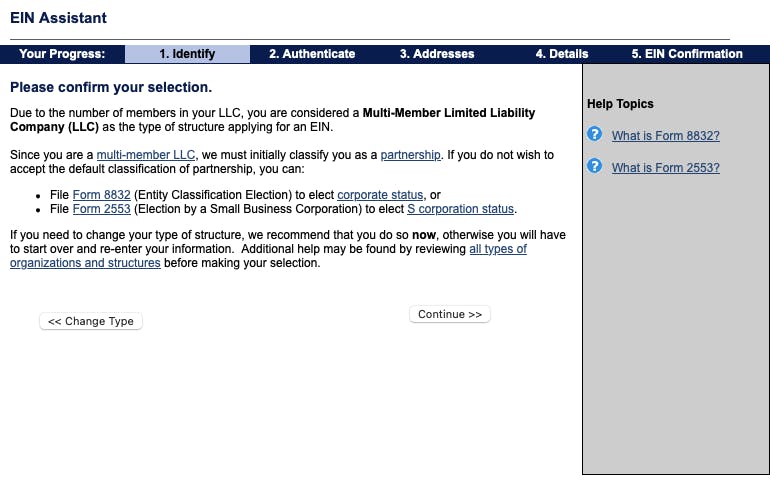

The proceeding page serves to inform you of your previous responses’ tax implications. The state you choose doesn’t matter as the default tax status is determined at the federal level. In short, a single-member LLC is taxed as a sole proprietorship, whereas a multi-member is a partnership. These are default tax classifications.

If you prefer an alternative classification, then you may submit the relevant form to the IRS. Remember, an LLC can be taxed as a sole proprietorship, partnership, S-Corporation, or C-Corp. This entity is the most flexible for available forms of taxation.

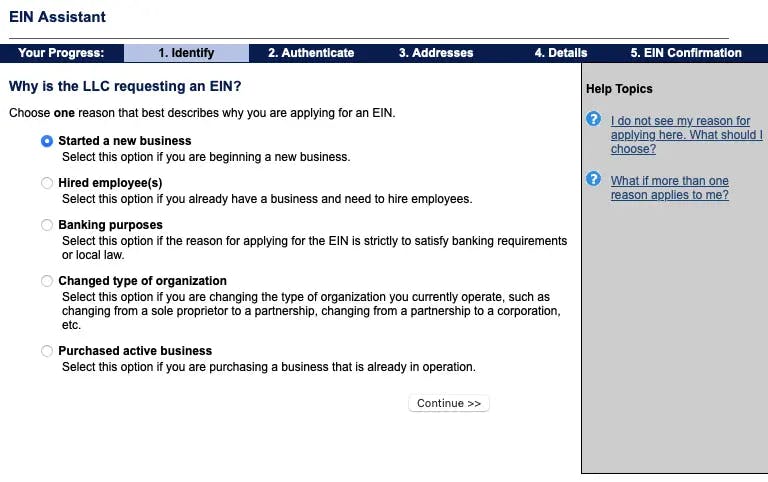

The online EIN guide will now ask why the company is requesting an employer ID. Our assumption is this is primarily for data collection purposes, as you will be given a number in either case and there are many reasons, often overlapping, for why you would want an Employer Identification Number. Those reasons include needing to file the Corporate Transparency Act with its Beneficial Ownership Information form, having employees, wanting a bank account, or doing so as a best practice given this is a new company. Select whichever makes the most sense for your situation and proceed to the next screen.

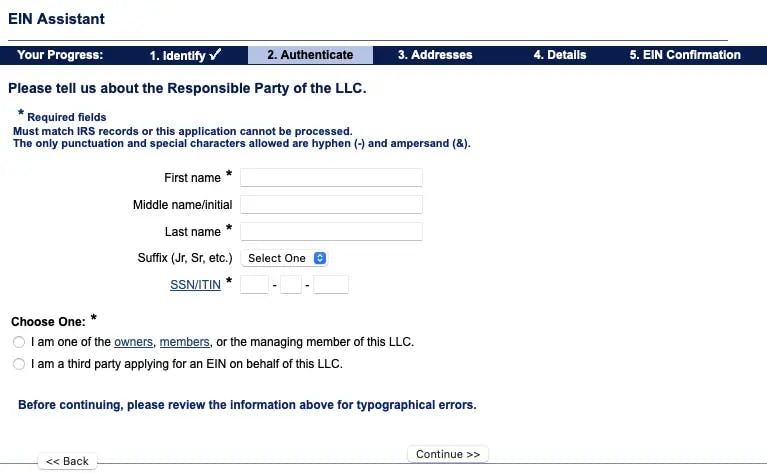

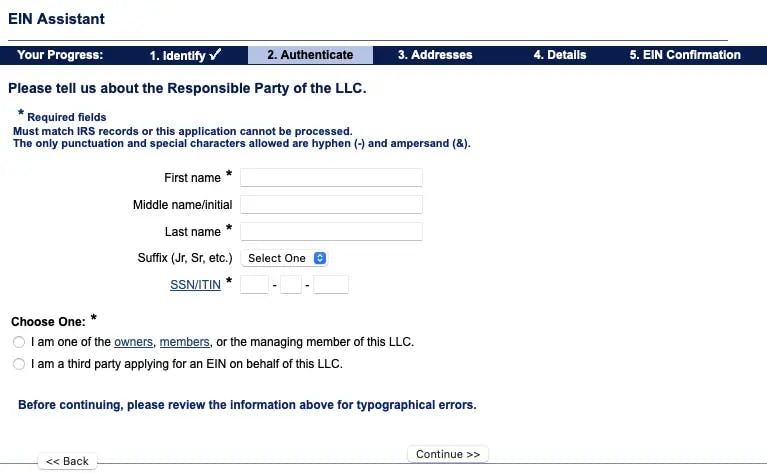

Next, you will be asked to provide the responsible party’s information, which includes their SSN. The responsible party must be a person. The IRS quit allowing the responsible party to be another entity in 2019. This was largely done to provide additional transparency on the beneficial owners of a company and to avoid nesting.

Thus, the responsible party must be a natural person who is both authorized to make decisions on behalf of the company and represent it for tax purposes. This generally means a member or manager of the LLC, or an officer or shareholder of a Corporation.

The question about whether you’re an owner or third-party designee is largely aimed at non-related individuals applying on the company’s behalf.

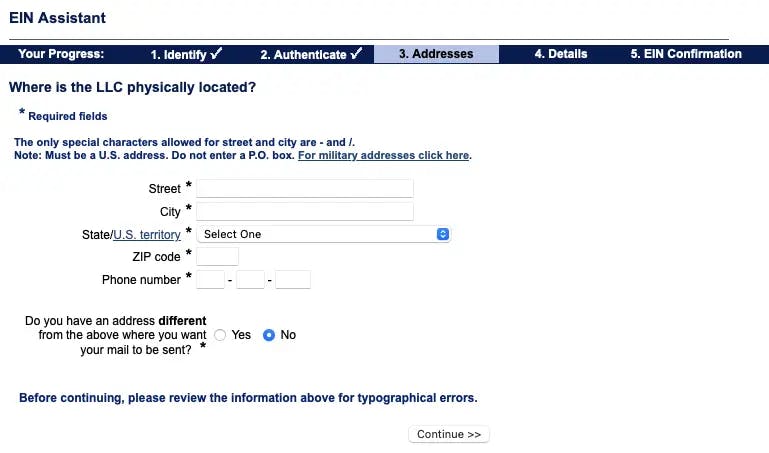

This page asks about the limited liability companies physical location, not where the Articles of Organization were filed. The physical location of the company is easy if you have a storefront or W2 employees. In those cases, you will want to list the state they are located.

In instances where there is a location independent company, or you have locations in multiple states, the answer is less obvious. Then you can sometimes list where the Articles were filed as it’s the most accurate, given there is no single location, but the IRS doesn’t provide additional guidance to make the choice crystal clear.

You must provide the address, city, street, zip code, and phone number. This is often where IRS notices will be sent, e.g. if you file an 8822-b to change the responsible party, or 8832 to elect S-Corp taxation, notification of the acceptance or declination will be sent here. If the physical address differs from the mailing address you have the option to declare so here as well.

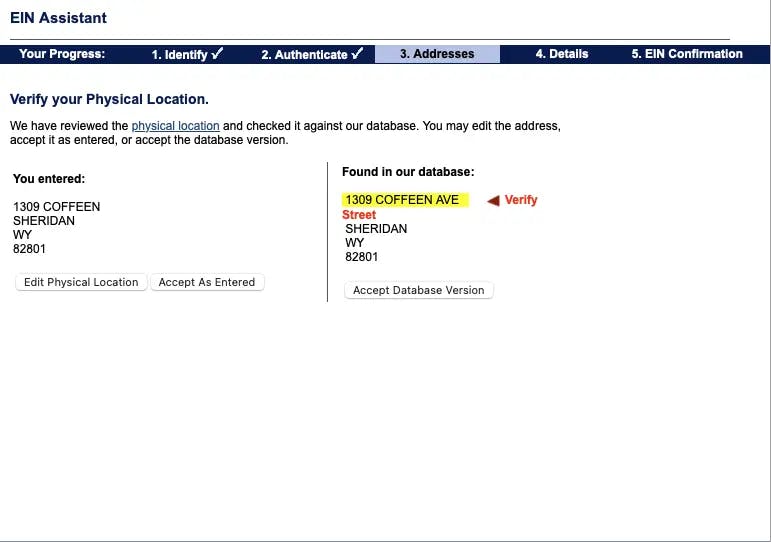

The address you enter must match the USPS database, or you will be presented with the following screen. You may select either your initial option or the one presented by the IRS. There are many cases where the local postman is familiar with it written one way and it won’t need to match the database exactly. The choice is left to you as it’s assumed you know your mailing address best. Special characters, such as commas or non-English characters, are not allowed.

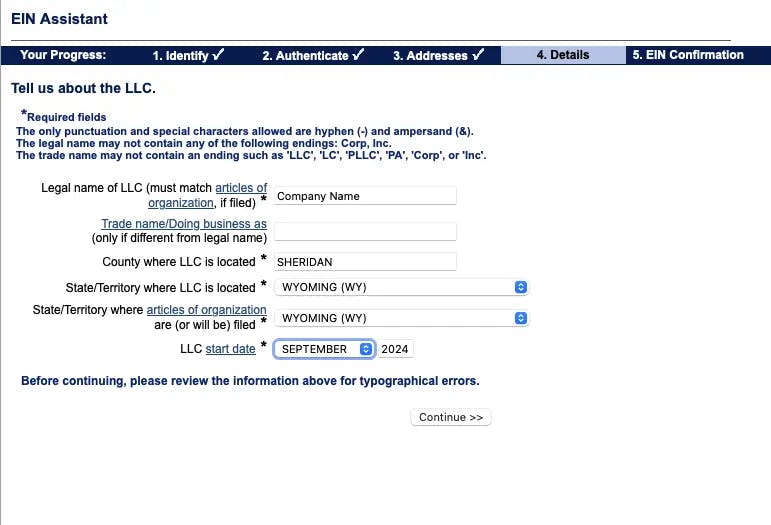

This section is the most technical as it asks for your company name, with the requirement it matches the Articles of Organization. Interestingly, though, the IRS will remove certain words from the EIN (CP-575) form it generates. For example, the word “The” will be removed, and “Trust” will be replaced with “IRRV TR” for Irrevocable Trusts. In short, the name you put into the field will not always be what populates on the CP-575. When applying for a bank account the banker should understand this and it’s rarely an issue.

Also, company names which are deemed too long, meaning those around 35 characters, will not have the full name recorded on the document. Presumably, the IRS’s database has the full record.

If you file a DBA or Trade Name, then it should also be populated here. This is only required if your company has such at the time of filing. If the DBA or Trade Name is filed later, then you do not need to update your SS-4 filing. That can be done when filing your annual taxes as needed.

The state and county are also required here. It asks first for where the “LLC is located” and then where the Articles are filed. There is also the company’s “start date”, which is when the entity begins doing business. Press “continue” when the page is complete.

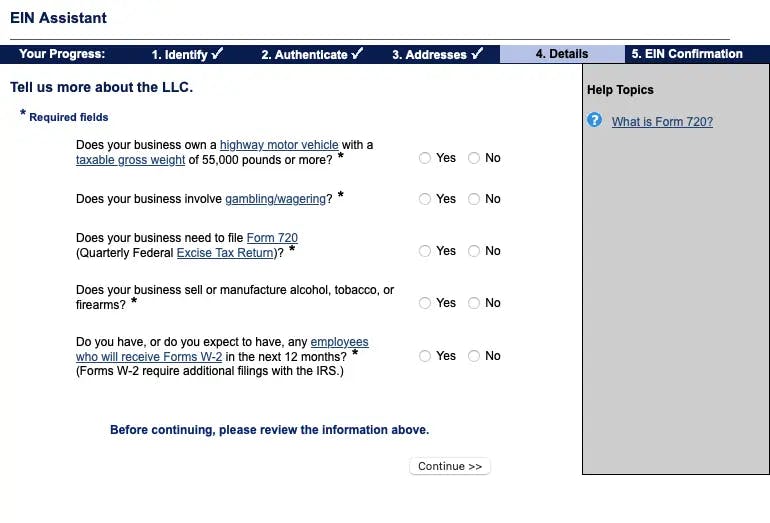

The next section allows the Internal Revenue Service to determine whether additional clarifying questions are required. For example, does your entity own a vehicle with a gross weight above 55,000 lbs, is it involved in gambling, needs to file an excise return, manufacture alcohol, tobacco, or firearms, and will you have W-2 employees in the next 12 months?

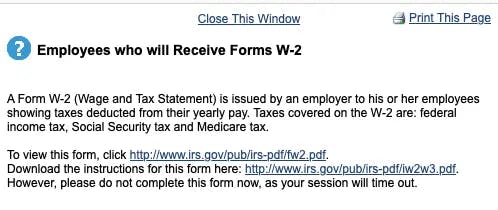

A Form 720 is the quarterly excise return. You should complete the form independently of this filing as the EIN will time out, per IRS instructions. The W-2 is a wage and tax statement issued by employers to employees for their annual pay. This covers taxes such as Medicare, Social Security, and federal income. Again, do not complete this form while on the IRS EIN page as you will time out.

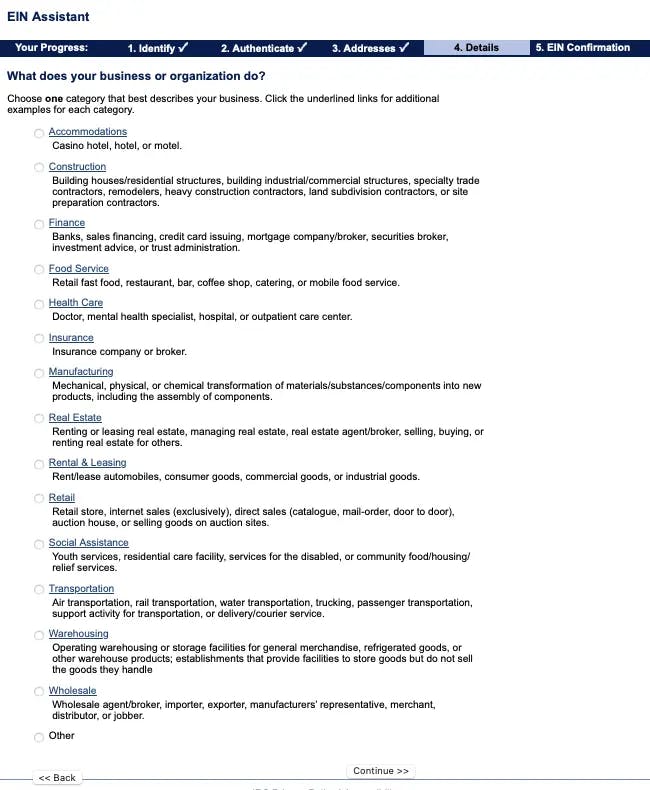

Here you’re asked a more particular question about your company’s industry and what it does. We show the initial page, however further follow depending upon what’s chosen. For example, if you choose real estate, then you are asked whether it’s a rental or lease, if you own it, use capital to build, sell, or manage for others, or “other” and you should specify. Depending on the answers to these there are a further set of questions.

Our belief is this section is created to determine your NAICS code, however we are not certain. It is used as part of the application. It determines whether your expenses are within the benchmark. For example, an entertainment company is likely to spend more on travel and entertainment (T&E) than a logistics company. What the IRS does with this information we cannot say.

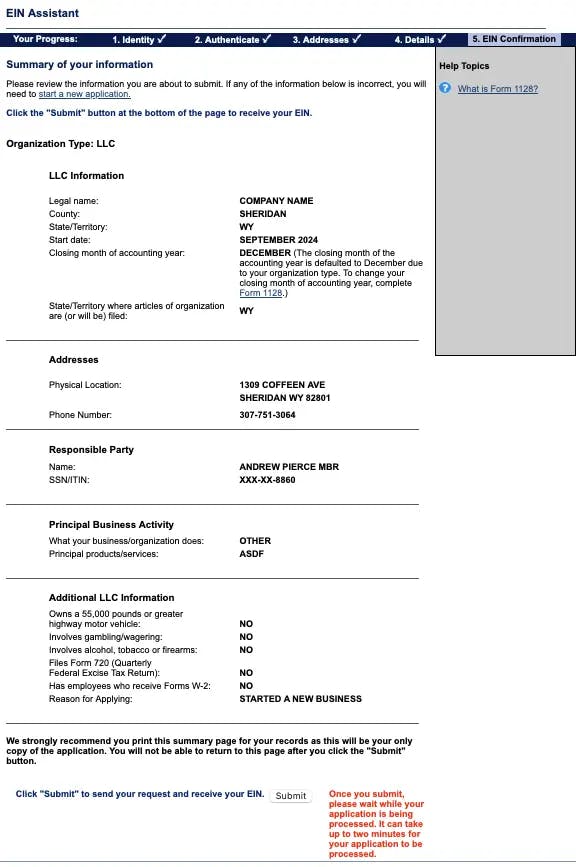

Once you complete the above sections you’re asked to verify the submitted information. Please review it in its entirety before hitting continue as this is your last chance. It recreates the information you provided above so you should recognize the answers as being your own.

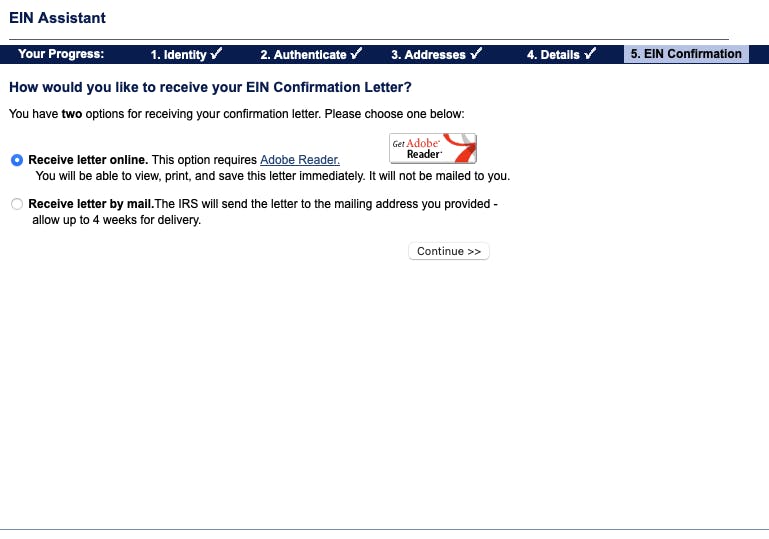

This is the simplest page of all, choose whether you want the form mailed or available instantly. We always recommend the instant option as it provides a .pdf you can download, save, print, and view anytime. The mailing option requires additional time and isn’t 100% reliable. Beyond potential issues with the IRS, USPS doesn’t have a 100% delivery rate either. This creates uncertainty about when or whether you’ll receive the number, sometimes necessitating an unnecessary callback.

In conclusion, obtaining an Employer Identification Number (EIN) is a vital step for every company. It's essential for tax filing, hiring employees, opening bank accounts, and more. While the process may seem challenging, our service ensures a stress-free experience, providing you with a free EIN and handling all necessary filings.

With this article, you can navigate the application process efficiently and effectively, ensuring compliance with regulatory requirements and setting your business up for success. Please fill out our contact form if you have any questions for us about forming your LLC.

AUTHOR

Brandi L. Joffrion, Esq.

Brandi Joffrion is a skilled attorney with extensive experience in diverse areas including litigation, estate planning, and creating limited liability companies and corporations. She is also a professor and former offshore anti-money laundering compliance officer. Brandi can provide you with particular advice on your specific situation in the areas listed above. Brandi is licensed to practice law in Colorado.